Wealth Visualization, See Your Financial Tree Grow

22 Nov 2024 - Tony Naccarato

Organization

Importance of Visualizing Financial Growth

Wealth visualization involves creating visual representations of your financial information. It helps individuals and businesses understand their financial situations better. This process allows one to see trends, patterns, and potential areas for growth. By breaking down complex financial information into simpler visual formats, wealth visualization becomes a powerful tool for keeping yourself organized.

Visualizing financial growth is essential for effective financial planning and tax planning. It provides a clear picture of where you currently stand financially. This clarity helps in setting realistic goals and identifying strategies for achieving them. Additionally, it allows for tracking progress over time. Financial goals can seem abstract, but visualization makes them tangible. It provides motivation and insight into one's wealth-building strategies.

Wealth visualization also enhances asset tracking. By understanding financial trends visually, one can make informed decisions. This approach fosters better financial habits and encourages proactive wealth-building strategies.

Introduction to Main Street Pulse and Its Mission

Main Street Pulse is a financial management platform designed to empower individuals in their wealth-building strategies. Its mission focuses on improving financial organization and enhancing asset tracking. The platform aims to change how users visualize their wealth and financial growth. Users can easily navigate their financial landscape. This empowers them to make informed decisions and take control of their financial futures.

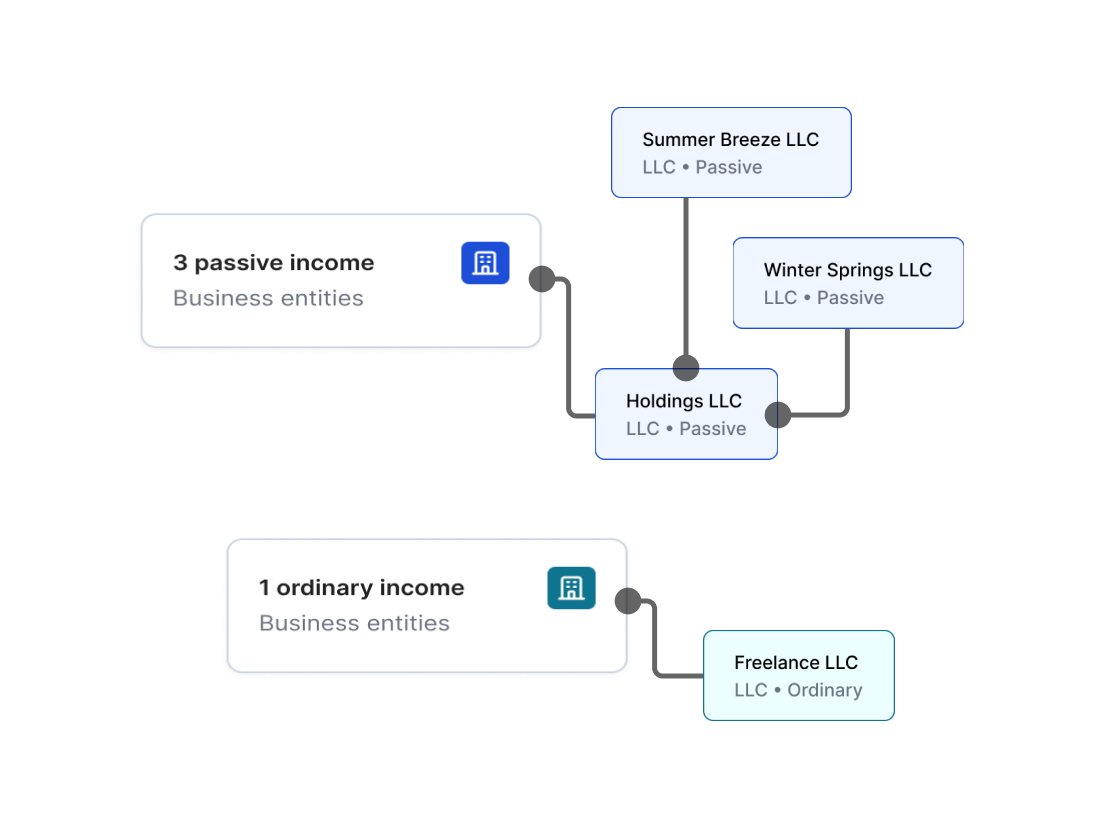

Main Street Pulse offers several key features that support effective wealth visualization. These features include:

- User-friendly interface: Provides a clear view of assets and liabilities.

- Financial organization tools: Helps users categorize investments and expenses.

- Comprehensive asset tracking features: Monitor all assets and business entities in one location.

How Effective Financial Organization Leads to Better Wealth Visualization

Financial organization is crucial for effective wealth visualization. When your finances are organized, you gain clarity. This clarity lets you see where your money is going and how it works. Wealth visualization becomes easier when you have a clear picture of your assets and investments. This process directly influences your ability to plan for passive income management and future growth.

Methods for Organizing Personal Finances

There are several methods for organizing personal finances. One popular method is creating a budget, which helps track income and expenses. This can be done through spreadsheets or apps. Another method is asset tracking, which keeps your assets updated and helps visualize your financial health. Additionally, utilizing financial planners and software can enhance your financial organization. These tools assist in mapping out wealth-building strategies, enabling better decision-making.

Key components of asset tracking include real estate, stocks, bonds, and other valuable possessions. Effective asset tracking lets individuals understand their net worth and make informed decisions regarding their wealth visualization. Additionally, it provides insights into areas for improvement in financial organization, ensuring that all assets are accounted for and properly managed.

How Main Street Pulse Assists with Real-Time Asset Tracking

Main Street Pulse stands out in asset tracking by offering a single tool for your financial assets. Its user-friendly interface allows users to input data effortlessly. This ensures that asset tracking is accurate and timely, crucial for making quick investment decisions. Accurate asset tracking significantly impacts wealth-building strategies:

- Understanding the complete picture of one's assets aids in strategic planning and tax planning.

- It promotes effective financial organization, allowing individuals to allocate resources more efficiently toward wealth visualization efforts.

- Through accurate asset tracking, users can build a robust financial foundation that supports long-term wealth-building strategies.

Strategies for Managing and Visualizing Passive Income Streams

Wealth visualization is crucial for effective passive income management. Tools like Main Street Pulse help users track their assets visually. Asset tracking allows individuals to monitor performance and make informed decisions. Regularly reviewing passive income streams ensures they align with overall financial goals. Wealth-building strategies include reinvesting profits, adjusting portfolios, and exploring new opportunities.

Success Stories of Individuals Using Main Street Pulse for Passive Income Management

With the right tools, passive income management becomes achievable for anyone.

Integrating Wealth Visualization

Wealth visualization plays a crucial role in strategy development. By envisioning financial goals, individuals can better outline their paths to success. For instance, creating a visual representation of passive income can clarify long-term objectives. This visualization helps in setting priorities. It aligns actions with financial aspirations. Integrating these visuals into daily routines reinforces commitment. With wealth visualization, individuals can track progress and adjust their strategies.

Visualization has transformed how people build wealth. Many now use charts and graphs to display their financial journeys. This shift allows for real-time assessment and adjustment of wealth-building strategies. For example, visually tracking asset growth can motivate further investments. When individuals see tangible results, they are more likely to stay on course. This method fosters accountability and encourages proactive financial management.

The Future of Wealth Visualization

Advancements in technology are transforming how individuals track and visualize their financial growth. Wealth visualization has evolved from traditional spreadsheets to interactive tools accessible to the average person. Financial organization is no longer reserved for experts. With user-friendly apps, everyone can engage in effective asset tracking. These innovations allow users to see their financial trees grow in real time.

Interactive tools and apps make wealth visualization accessible to everyone, not just financial experts. Users can now monitor their investments and savings with ease. Real-time data and analytics empower users to make informed decisions. This level of access helps individuals actively manage passive income management. Personalized financial dashboards present a clearer picture of one's financial health and future potential. They simplify complex data into understandable visuals that enhance decision-making.

This future of wealth visualization will emphasize tracking assets and proactively managing them for sustained growth. Users will increasingly rely on these intelligent systems to navigate their financial journeys.